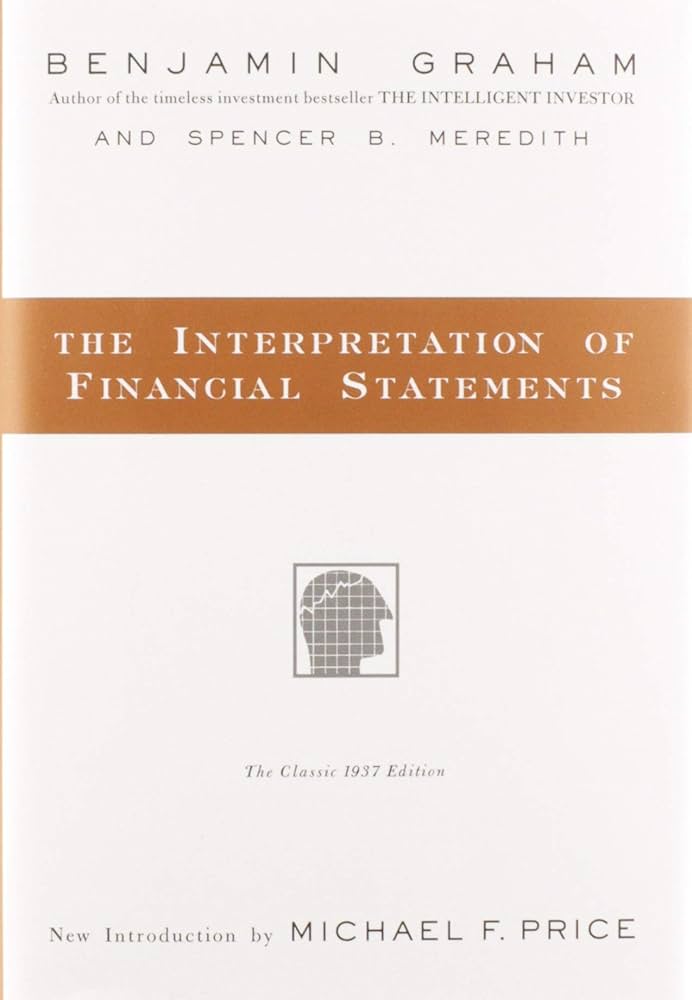

Msbookreview.com, are you trying to decode the complex world of financial statements but need help figuring out where to start? The Interpretation of Financial Statements by Benjamin Graham and Spencer B. Meredith might be the perfect guide.

This timeless classic offers a straightforward, practical approach to understanding financial statements, making it an invaluable resource for investors, business owners, and anyone looking to make informed financial decisions.

Whether you’re a novice or a seasoned investor, this book can help you gain clarity and confidence in interpreting the numbers that drive business success.

Table of Contents

ToggleAuthor of The Interpretation of Financial Statements

Benjamin Graham and Spencer B. Meredith co-authored the Interpretation of Financial Statements. Benjamin Graham, often referred to as the father of value investing, is a legendary figure in finance.

His teachings have influenced generations of investors, including Warren Buffett, who has famously praised Benjamin Graham’s work. Benjamin Graham’s expertise in financial analysis and his systematic approach to investing have made him a foundational figure in modern finance.

Spencer B. Meredith, an experienced financial analyst and co-author, brought a practical perspective to the book, ensuring that the concepts were accessible to readers at all levels.

Synopsis of The Interpretation of Financial Statements

Initially published in 1937, The Interpretation of Financial Statements is a concise yet comprehensive guide to understanding the three primary financial statements: the balance sheet, the income statement, and the cash flow statement.

The book is structured to gradually build the reader’s knowledge, starting with the basics and progressing to more advanced concepts.

According to Benjamin Graham and Spencer B. Meredith, the balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and shareholders’ equity.

The authors explain how to interpret each balance sheet component, offering insights into what the figures represent and how they interrelate.

The income statement, or profit and loss statement, is examined next. This financial statement shows a company’s financial performance over a particular period, highlighting revenues, expenses, and profits.

Benjamin Graham and Spencer B. Meredith guide readers through analyzing income statements, emphasizing the importance of understanding how various costs and revenues impact overall profitability.

Finally, the cash flow statement is discussed, providing an overview of the inflows and outflows of cash within a business.

The authors explain how cash flow analysis can offer a more accurate picture of a company’s financial health, particularly in conjunction with the other two statements.

The book also covers key financial ratios, such as the current, quick, and price-to-earnings (P/E) ratios. It explains how these metrics can be used to evaluate a company’s financial Stability and performance.

Advantages of The Interpretation of Financial Statements

One of the key strengths of The Interpretation of Financial Statements is its clarity and accessibility. Benjamin Graham and Spencer B. Meredith succeed in demystifying complex financial concepts, making the book suitable for readers with little to no background in finance.

The straightforward explanations and practical examples provided throughout the book allow readers to grasp the fundamentals of financial statement analysis quickly.

Another advantage is the book’s timeless relevance. Despite being published over 80 years ago, the principles and methods outlined in the book remain applicable today.

Financial statements have not changed significantly over the decades, and the insights provided by Benjamin Graham and Spencer B. Meredith continue to offer valuable guidance for analyzing companies in the modern business environment.

The book’s focus on practicality is also noteworthy. Rather than overwhelming readers with excessive technical details, the authors emphasize the most critical aspects of financial statement analysis, equipping readers with the tools they need to make informed decisions.

This pragmatic approach makes the book valuable for investors, business owners, and managers who need to understand their company’s financials.

Disadvantages of The Interpretation of Financial Statements

While The Interpretation of Financial Statements is an excellent resource, it has one potential drawback: its brevity.

At just over 100 pages, the book provides a concise overview of financial statement analysis, but it may leave some readers wanting more in-depth coverage of specific topics.

Additional resources may be necessary for those seeking a more comprehensive exploration of financial analysis.

Another limitation is the book’s focus on traditional financial metrics. While these metrics are still widely used, the modern economic landscape has evolved, and new tools and technologies offer alternative ways to analyze financial performance.

Readers may need to supplement the book with more contemporary resources to understand today’s economic analysis practices fully.

The book’s age also means some examples and context may need to be updated. While the fundamental principles remain relevant, readers should know that the business environment has changed since the book’s initial publication. Some of the specific references may not apply to today’s markets.

Personal Opinion about The Interpretation of Financial Statements

I have a personal opinion about this book. Although I have encountered many financial books, The Interpretation of Financial Statements remains one of my favorites for its simplicity and practicality.

Benjamin Graham and Spencer B. Meredith have created a guide that is informative and highly accessible, making it an excellent starting point for anyone looking to understand financial statements.

The book’s emphasis on the basics of financial analysis is particularly valuable for beginners. It provides a solid foundation that readers can build upon as they gain more experience and knowledge.

Even for seasoned investors, the book is a helpful refresher on the core principles of financial statement interpretation.

However, I also recognize that the book’s brevity and focus on traditional metrics may only satisfy some. Additional resources may be necessary for those looking for a deeper dive into financial analysis or more contemporary examples.

That said, The Interpretation of Financial Statements is essential for anyone serious about understanding a company’s financial health.

Moral Message of The Interpretation of Financial Statements

The moral message of The Interpretation of Financial Statements is that financial literacy is crucial for making informed decisions.

Benjamin Graham and Spencer B. Meredith emphasize the importance of understanding the numbers behind a business to assess its actual value and potential.

By mastering the basics of financial statement analysis, readers can avoid common pitfalls and make more rational, data-driven decisions.

The book also teaches the value of discipline and critical thinking in financial analysis. Benjamin Graham and Spencer B. Meredith encourage readers to approach financial statements with a skeptical eye, looking beyond surface-level figures to understand the underlying dynamics of a business.

This analytical mindset is essential for anyone looking to navigate the complexities of the financial world with confidence and success.

Conclusion

The Interpretation of Financial Statements by Benjamin Graham and Spencer B. Meredith is a timeless guide offering invaluable insights into financial analysis.

Whether you’re a novice investor or an experienced business owner, this book provides a clear and practical approach to understanding financial statements, helping you make informed decisions based on solid analysis.

While the book’s brevity and focus on traditional metrics may not cover all the nuances of modern financial analysis, its foundational principles remain as relevant today as they were when the book was first published.

The Interpretation of Financial Statements is a must-read for anyone serious about improving their financial literacy and making smarter investment choices.

As you delve into this classic text, you’ll gain the knowledge and confidence to interpret financial statements clearly and precisely.

In a world where financial literacy is more important than ever, The Interpretation of Financial Statements offers a timeless roadmap for navigating the complexities of business finance.