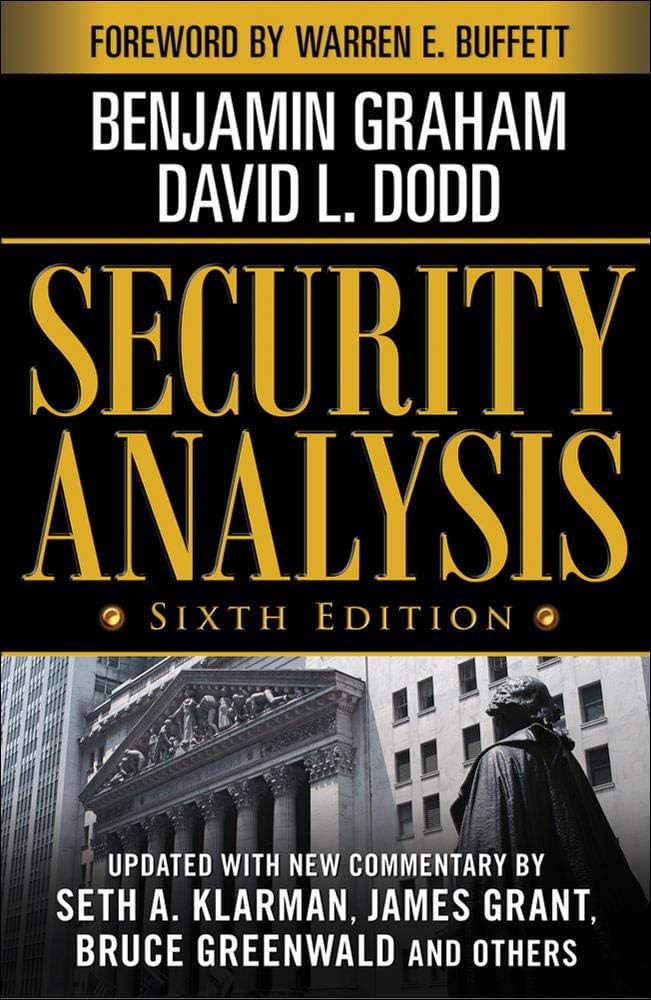

Msbookreview.com, are you looking for a comprehensive guide to investment analysis that has stood the test of time? Security Analysis by Benjamin Graham and David Dodd is often hailed as the Bible of value investing.

This seminal work is not just a book; it’s a deep dive into the principles and methodologies that have shaped modern financial analysis.

Whether you’re an experienced investor or a finance enthusiast, Security Analysis offers invaluable insights that continue to resonate in today’s volatile market.

Table of Contents

ToggleAuthor of Security Analysis

Security Analysis was co-authored by Benjamin Graham and David Dodd, two towering figures in finance. Benjamin Graham, the father of value investing, was a professor at Columbia Business School and an influential economist.

His groundbreaking work laid the foundation for many of today’s investment strategies. David Dodd, also a professor at Columbia, collaborated with Benjamin Graham to bring a rigorous academic perspective to the field of securities analysis.

Together, their work has influenced generations of investors, including Warren Buffett, who regards Security Analysis as an essential resource for understanding the art and science of investing.

Synopsis of Security Analysis

Security Analysis, first published in 1934 during the Great Depression, is a detailed examination of investment analysis and valuation techniques.

The book introduces the concept of intrinsic value, which is the true worth of a security based on its underlying financials rather than its current market price.

Benjamin Graham and David Dodd emphasize the importance of thorough financial analysis in determining whether a security is undervalued or overvalued by the market.

The book is divided into sections that cover different types of securities, including stocks, bonds, and convertible issues.

It provides an in-depth discussion of financial statement analysis, dividend policy, and the concept of margin of safety, which is the principle that investors should buy securities at prices significantly below their calculated intrinsic value to minimize risk.

One of the critical contributions of Security Analysis is its distinction between investment and speculation. Benjamin Graham and David Dodd argue that investment is based on careful analysis and aims to provide a satisfactory return for the risk, while market trends and emotions drive speculation.

This distinction forms the core of value investing, focusing on long-term wealth accumulation through disciplined and informed decision-making.

Advantages of Security Analysis

Security Analysis stands out for its rigorous and systematic approach to evaluating securities. One of the book’s major strengths is its comprehensive coverage of different asset classes and its emphasis on the importance of financial statement analysis.

Benjamin Graham and David Dodd provide readers with a solid framework for assessing a company’s financial health, enabling them to make informed investment decisions.

Another advantage of the book is its timeless relevance. Despite being written nearly a century ago, the principles and methodologies outlined in Security Analysis are still applicable in today’s financial markets.

The book’s focus on intrinsic value, margin of safety, and the distinction between investment and speculation continues to guide investors in navigating market complexities.

The book also offers a wealth of real-world examples and case studies, illustrating how the authors’ theories can be applied in practice.

These examples help bridge the gap between theory and application, making the book informative and practical for those looking to implement value-investing strategies.

Disadvantages of Security Analysis

While Security Analysis is a foundational text in investing, it has challenges. One of the primary drawbacks is its complexity.

The book is dense, and its language can be complex for readers who need to be better versed in financial terminology.

For beginners, the depth and detail of the analysis may be overwhelming, requiring multiple readings to grasp the concepts thoroughly.

Additionally, the book’s age is both a strength and a weakness. While the core principles remain relevant, some examples and case studies need to be updated to reflect the economic conditions of the early 20th century.

Modern readers may need to supplement the book with more recent resources to understand the financial landscape.

Another potential disadvantage is the book’s focus on value investing, which excludes other investment strategies.

At the same time, this focus makes the book a classic in value investing circles; readers interested in growth investing or different approaches may find the content less applicable to their needs.

Personal Opinion about Security Analysis

As someone who read this book, I have a personal opinion about it. I can say that Security Analysis remains a cornerstone of financial literature.

Benjamin Graham and David Dodd’s systematic investment analysis approach is unparalleled in depth and rigor.

Their emphasis on intrinsic value and margin of safety has profoundly influenced my understanding of investing and has shaped my current strategies.

However, I also recognize that Security Analysis is only for some. The book requires a significant investment of time and effort, and its dense content can be challenging for those new to finance.

That said, the rewards are immense for those willing to put in the work. Security Analysis provides a framework for investing that is as relevant today as when it was first published.

I recommend this book to anyone serious about mastering the art of investing. While it may be challenging to navigate at times, the insights it offers are invaluable for building a solid foundation in securities analysis and value investing.

Moral Message of Security Analysis

The moral message of Security Analysis is centered on the importance of disciplined and informed investing.

Benjamin Graham and David Dodd emphasize that successful investing is not about chasing market trends or speculating on short-term gains but conducting thorough analysis and making decisions based on a security’s intrinsic value.

This disciplined approach helps investors avoid the pitfalls of speculation and build long-term wealth. The book also highlights the importance of a margin of safety.

This concept encourages investors to seek a buffer between the price they pay for a security and its intrinsic value.

This principle safeguards against market volatility and uncertainty, ensuring that investors do not overpay for assets and are better protected against losses.

Ultimately, Security Analysis teaches readers that investing is a rational process that requires patience, discipline, and a focus on fundamentals.

By adhering to these principles, investors can confidently navigate the financial markets and achieve sustainable economic success.

Conclusion

Security Analysis is more than just a book; it’s a comprehensive guide to the principles and practices of value investing.

Benjamin Graham and David Dodd’s work has stood the test of time, offering relevant insights into today’s ever-changing financial landscape.

While the book may be challenging for some, its lessons are invaluable for anyone serious about investing. Whether you’re a seasoned investor or just beginning your financial journey, Security Analysis provides a robust framework for evaluating securities and making informed decisions.

Its emphasis on intrinsic value, margin of safety, and disciplined analysis offers a timeless approach to building long-term wealth.

As you delve into the pages of this classic text, you’ll gain the knowledge and confidence needed to navigate the complexities of investing with wisdom and foresight.